31/12/2020

This start out to be a Revit blog. But now I am sharing more of my ASX trading journey. Hope you enjoy!

Thursday, December 31, 2020

31/12/2020 ASX:FMG

Wednesday, December 30, 2020

30/12/2020 ASX:IRI, WEB

30/12/2020

What did I do: I short on open as it tick up to 5.26 (bad entry) thinking yesterday close on 5.32 was too high.. straight after my entry WEB shoot up to 5.33. stonk effect is working . End up close at 5.23 as the support is too strong

What I should do : I should short APT and SZL, as there is more meat to drop.

31/12/2020

Verdict: WEB dropped on market weak 31/12/2020 on open to 5.23 and dropped more on 12pm to 5.09 :- should keep to my thesis...

Sunday, November 1, 2020

1/11/2020 Trading Edges (November Goal)

I am writing this to remind myself about the setup i should be looking at.

Basically 12pm lunch time, look out for intraday high volume trading

a) Oversold, buy for bounce or next day.

b)Week support, short for overnight fall.

Keep it simple will be November month ongoing trade , to keep my discipline

Goal to clear out my current holding.

Update - cleared my current position

cut loss on NUF but it was moving north after I cut ... bummer

Monday, October 26, 2020

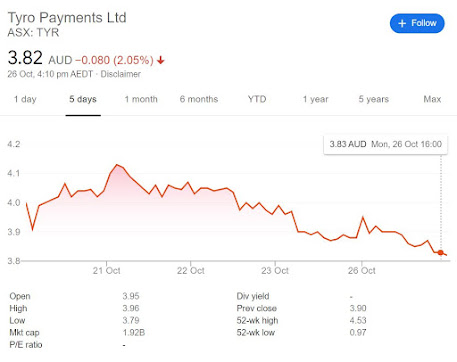

26/10/2020 ASX:TYR

TYR

26/10/2020 ASX:SBM

SBM

Sunday, October 25, 2020

12/10/2020 ASX:NUF

NUF

23/10/2020 ASX ILU, CCX

Looking back I will still buy it, the value is there, potential bounce, the risk is if dow jone red on friday. the following week will trending down.

Update on 26/10/2020

Monday unpredicted Retail stock slump, dropped 6% ; still holding waiting for breakeven

Verdict closed on 28/10/2020 , it up 7% , consider lucky to cut loss with 24 aud

I have read the playbook by mike bellafiore. I decided to start putting up my trading journal to hold myself accountable. I hope by documenting this will bring more improvement on my future trading.